Software Sales Tax 101

Software as a Service is a compelling recurring revenue model for software development companies when it comes to growing cash flow. The Software as a Service (SaaS) model creates a terrific revenue stream but also creates some new and fairly significant transactional tax challenges for software companies.

Software companies and the requirement to collect sales tax

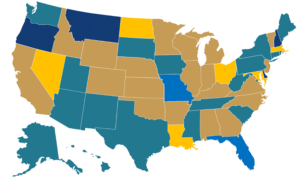

Almost half of the States have existing tax laws that make Software as a Service subject to sales tax. It totally depends on the state you are selling in, where your customer resides, what the type of product you are selling.

Software companies are required to collect sales tax from buyers in states when they meet two conditions:

1. A company has physical or economic nexus in the state

2. The product or service the company is selling is taxable in that state

Let’s break this down a step further:

If I don’t have Nexus, why should I collect sales tax?

“Nexus” means that your company has a physical connection to the state you are selling. You either have a store front, a warehouse, a sales person working in that state, etc.

Conditions that create nexus include:

Charging the correct sales tax rate

This is where it gets tricky; every state establishes its own sales tax rates. Companies need to stay on top of the tax codes and changing rates at all times. Sales Tax is made up of multiple rates. You could have a state rate, plus a county rate, then a city rate and taxing district. Each jurisdiction has their own sales tax rate which can get very hard to keep up with.

Sales tax is charged at the point of sale. The point of sale relates to where your customers’ billing address is for the purchased product. This, coupled with the different tax rates in each jurisdiction, makes it difficult to keep up with the right charges of sales tax rates for each customer.

Modas ensures you charge the right amount of sales tax from the right customer, every single time. With Momemtum for Saas, we also ensure you’re collecting and reporting the right amount of sales tax to the states and our sales tax solution is automated – you set it and forget it!

Momentum for Software solves:

Economic Nexus Decisions:

The states which you are legally required to collect, file, and remit sales tax in each state

Foreign Entity Registration:

In other jurisdictions and their respective general jurisdiction requirements

Collection, Filing and Remittance:

Of all transactional taxes in each state you have sales

State Corporate Income Tax:

In each state you have sales

Agent Commissions:

Portal with real time visibility on accrued commissions for your Agents

Electronic Agent Signup:

With digital signature capture of Agent agreement

Our Customer Support Team Scales with your Business Needs.

Set it and forget it with our white label customizable solution.

Our ongoing support team will help your business scale and adapt to growth and future needs.

Or Give Us A Call At

(888) 256-0060