ADD VALUE TO

YOUR CHANNEL

Top 3 Reasons to Choose Modas Systems

Modas + Underlying Provider |

DIY Underlying Provider |

|

| Regulatory Requirements | Modas operates as the licensed telecom provider, eliminating the need for channel partners to file an FCC 499-A – improving speed to market | Underlying Providers need to verify every channel partner has filed an FCC 499-A with the Commission – prior to selling services as required by federal law §64.1195(h) |

| Tax Exemption Management | Modas is responsible for maintaining exemptions for every state your channel conducts business | Underlying Providers obtain resale tax exemptions from every state channel partners conduct business |

| Internal Use Billing | Modas invoices channel partners who purchase your services for internal use – while you maintain a wholesale filing status | Underlying Providers need to ensure channel partners purchasing services for internal use are billed the correct retail taxes monthly |

Three simple steps and your channel tax compliance is set!

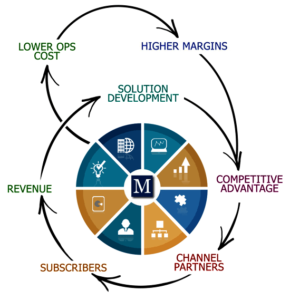

Modas Systems Solution At Work

Modas carries the responsibility for your channel partners tax compliance. We operate as the Telecommunications provider.

Acting as the “Master Reseller,” Modas accurately and appropriately handles the taxes and when applicable, all state tax filing and federal regulatory filings and remittance.

Channel Partners still drive the customer relationship, set the terms and pricing and control recurring revenue while Modas takes care of staying compliant in the eyes of the government.

Modas Benefits

Click here to learn more about the benefits of utilizing Modas for your Channel’s Tax Compliance.

Modas understands the importance of regulatory requirements and is dedicated to helping organizations get its tax compliance system and strategy right, while allowing you to deliver an exceptional channel partnership while sustaining a competitive advantage.

Interested in Modas’ Tax Compliance Solution?

Or Give Us A Call At

(888) 256-0060